Save an Average of $1,000 on Closing Costs

With a fully insured attorney opinion letter that provides similiar protection as traditional title insurance, at a fraction of the cost. Link Title is proud to be an authorized AOLPro provider, offering this innovative title alternative to lenders, homebuyers, and investors nationwide.

How AOLPro Works with Link Title

Link Title manages the complete AOLPro process using the same proven workflow as traditional title services. Here’s how it works from order to recording:

AOLPro Production

The process begins with API-driven data aggregation from multiple sources including title data, public record data, and tax records. This is followed by data processing and thorough search and exam procedures to generate a Preliminary AOLPro Report.

Curative Process

Once the preliminary review is complete, any gaps or issues in the chain of title are addressed using task-based curative processes embedded in the AOLPro Platform. Once issues are cured, an updated AOLPro is generated and a quality control review is completed.

Attorney Review

After Lender’s Closing Instructions are received, the Final AOLPro Package undergoes a detailed, checklist-based review process by an experienced attorney. This ensures all requirements have been met and the AOLPro is accurate, complete, and compliant. Once attorney review is complete, a conditional AOLPro is issued.

Closing Process

Closing documents are packaged and prepared for signature. Closing, settlement, and escrow processes are completed, aligning with existing expectations and SLAs.

Post Closing

Once closing documents are signed and a post-closing QC check is performed, the Final AOLPro is issued. Even though the AOLPro provides coverage through the time of recording, there is no need to wait for the recorded documents to issue the Final AOLPro.

Recording

Once post-closing QC is complete and the Final AOLPro has been issued, closing documents are sent for recording and the AOLPro is reported to the insurer.

How Much Can You Save?

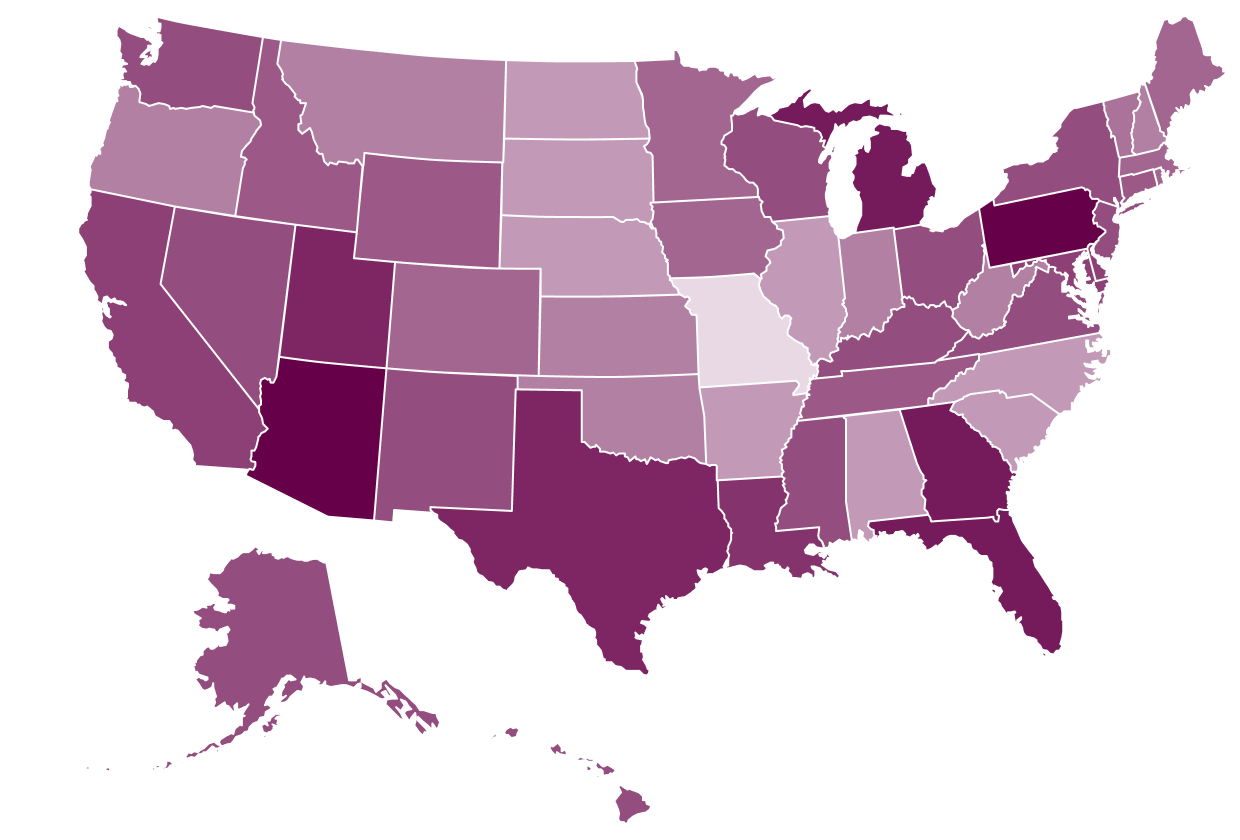

Title insurance costs vary dramatically by state. AOLPro can save homebuyers and borrowers anywhere from 14% to 66% on title-related closing costs depending on the property location and transaction type.

Example savings on a $475,000 transaction:

Want to see what you could save in your state? Check out Alita Group’s interactive map showing title insurance costs and AOLPro savings for all 50 states.

The map breaks down estimated costs for both purchase and refinance transactions at different price points, so you can see exactly how much AOLPro could save your clients or yourself. The darker the state the bigger the savings!

AOLPro Coverage Comparison

Not all attorney opinion letters are created equal. AOLPro offers coverage comparable to traditional title insurance, protecting homebuyers, lenders, and future investors alike.

Questions from Lenders & Servicers

Everything you need to know about working with us.

We Believe…

in delivering exceptional service through collaboration and teamwork that builds lasting relationships and drives our clients’ success.